Corporate Transparency Act Filing Requirement Reinstated

[Update: 3/3/2025]

FINCEN has released a statement that it will not take enforcement actions against companies that fail to file or update beneficial ownership information by current deadlines. They intend to issue an interim rule extending filing deadlines no later than March 21, 2025.

[Original Story]

Despite continuing legal battles, many companies are now once again required to report ownership information to the Financial Crimes Enforcement Network of the United States Treasury (FinCEN). The Department of Justice appealed a stay on FINCEN's reporting requirements, and their appeal of the stay was granted. The reporting requirement comes from the Corporate Transparency Act passed in 2021. Companies created before 2024 that are required to report have until March 21, 2025 to file.

The American Dental Association is supporting legislation, HR 736, by Representative Zachary Nunn, R-Iowa, that would delay filing requirements instituted in the Corporate Transparency Act. The new legislation would extend filing deadlines by a year. HR 736 was just approved in the House and now moves to the Senate.

FINCEN’s New Reporting Deadline Notice

Does this affect my practice?

Many dental practices will likely be required to file unless they meet exemption requirements.

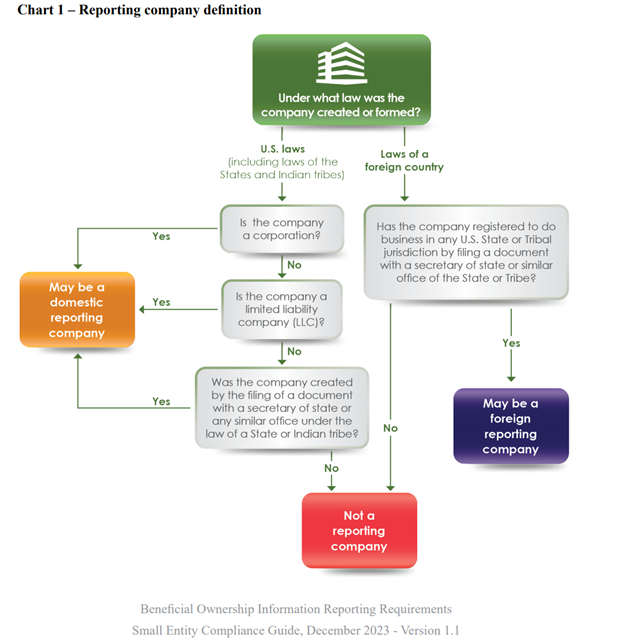

Looking at the flowchart on page 2 of FinCEN’s Small Entity Compliance Guide (see above), companies may be required to report if they are corporations, LLCs, or created through “the filing of a document with the secretary state…under the law of a State.” The document goes on to list a series of exemptions for various businesses. All of the exemptions have a checklist that can be found in the guide. Exempt companies fall into at least one of 23 categories. Many of these categories are related to financial services.

Others include tax exempt entities, subsidiaries of exempt entities, inactive entities, large operating companies, and publicly traded firms. Dental practice owners should especially take note of the one for large operating companies. Firms that employ more than 20 employees with gross receipts greater than $5,000,000 may be exempt from reporting under the Corporate Transparency Act. Check the checklists on pages 4-14 of FinCEN’s Small Entity Compliance Guide for more details.

What do I have to report?

Filing is to be done electronically via the official government website. Reportable information includes some basic information about the company as well as information on beneficial owners. A beneficial owner is any person who either exercises substantial control over the reporting company or owns 25% or more of a company’s ownership interests. People exercising substantial control include senior officers and other important decision makers. Ownership interests may include equity, stock, voting rights, and capital or profit interest in an LLC among other things. FinCEN has provided a series of steps in its guide for identifying beneficial owners.