The Consolidation of Georgia’s Dental Insurance Market

Recent guidance put out by the United States Department of Justice suggests that Georgia’s dental benefits market is likely highly concentrated. In 2023, the department of justice released new merger guidelines with adjusted definitions of market concentration. The new guidelines lower the thresholds for which new mergers are presumed to reduce competition or promote monopoly, shifting Georgia toward a different classification of market competitiveness. Regardless of classification, market consolidation of payors is something all dental providers should be keenly aware of since it has the potential to influence the future practice of dentistry.

Measuring Market Concentration

Historically, federal authorities have used the Herfindahl-Hirschman Index (HHI) to measure market concentration. The index scores market concentration on a scale of 0 to 10,000. Lower numbers represent higher competition, and 10,000 means a monopoly exists. To calculate the index, analysts determine the market share of firms within a target market, square each firm’s market share, and then add up the squares to get a final score.

HHI is a blunt instrument for analyzing market competitiveness, and it is not without criticism. Criticism of the instrument suggests that HHI misses market nuances, cannot assess dynamic aspects of competition, and may over/understate the value of small competitors. Furthermore, HHI may be a poor tool for assessing network industries where the value of goods increases with the expected numbers of units sold by a given firm. Despite these critiques, HHI remains a useful, and accessible, tool for general exploration of market concentration.

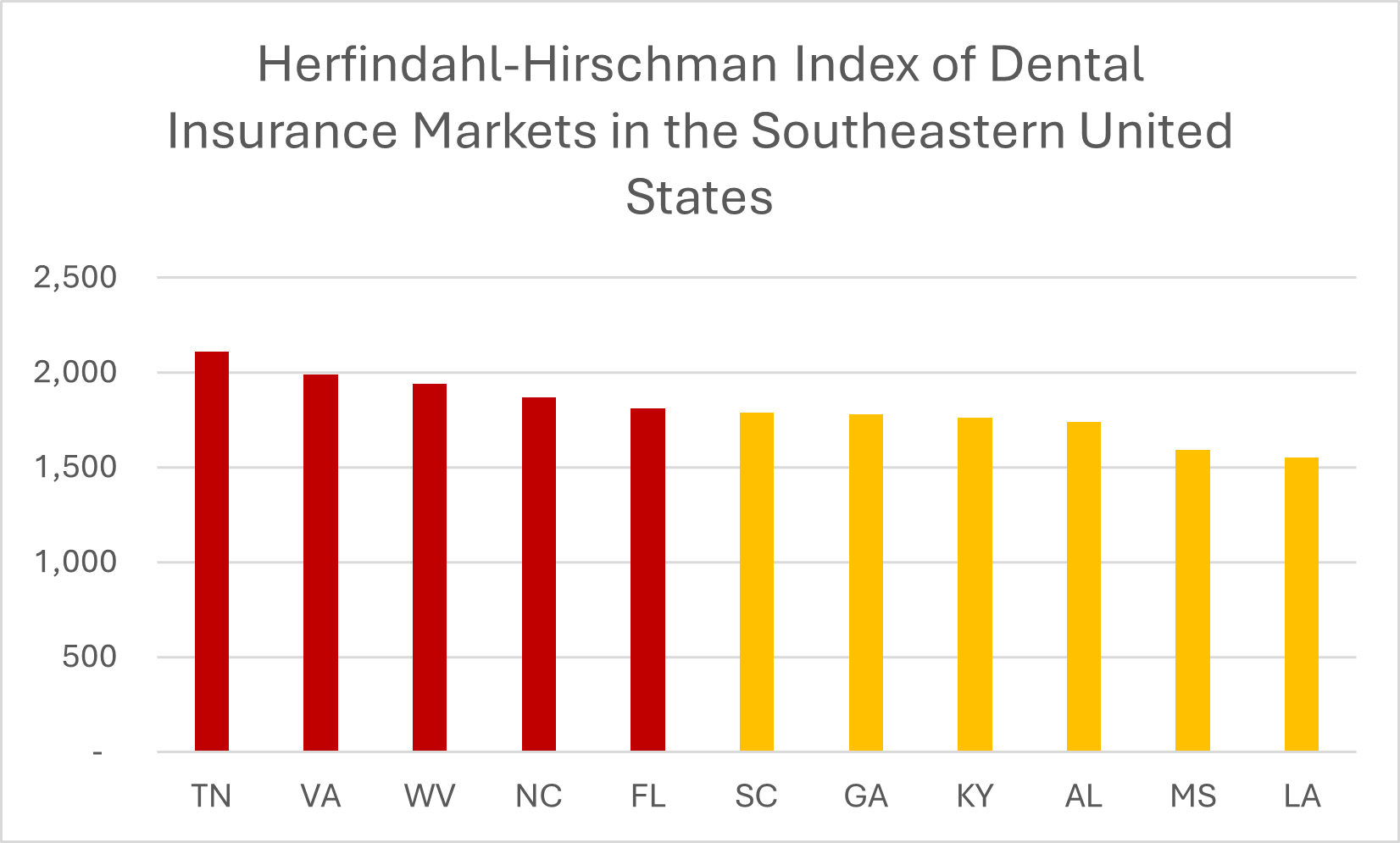

When the American Dental Association looked at market consolidation by state in 2019, they found that Georgia scored a 1,780 on the index. At the time, this put it at the low end of a moderately competitive market rating and close to the middle of the pack relative to nearby states. Previously, a market was considered moderately competitive if HHI fell between 1,500 and 2,500. With the advent of more stringent competition guidelines comes a different sense of the competitiveness of Georgia’s benefits market. The new guidelines shift the scale back to an era of more robust antitrust enforcement, and now any HHI above 1,800 is considered to be a highly concentrated. Georgia’s HHI was just a hair below this threshold.

Source: How Competitive Are Dental Insurance Markets? American Dental Association Health Policy Institute. November, 2019. Accessed July 24, 2024. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/hpigraphic_1119_4.pdf and Nasseh, K., Bowblis, J. R., Vujicic, M., & Huang, S. S. (2020). Consolidation in the dental industry: a closer look at dental payers and providers. International Journal of Health Economics and Management, 20(2), 145–162. https://doi.org/10.1007/s10754-019-09274-x Notes: Red indicates a highly concentrated market (HHI > 1,800), and yellow indicates a moderately concentrated market (HHI 1,000-1,800) according to 2023 federal guidelines. The original analysis was based on the 2015 FAIR Health Dental Benchmark Module with HHI calculation based on the market share of each insurer’s paid claims.

The Harvard Business Review offers a slightly different, but helpful, framework for thinking about market consolidation. They posit 4 stages in the industry consolidation life cycle, each defined by the combined market share of an industry’s 3 largest companies: opening (<30%), scale (15%-45%), focus (35%-75%), and balance and alliance (70%-90%). Some suggest that the dental industry as a whole is moving between the scale and focus stages of the curve, on a parallel trajectory with larger trends in healthcare consolidation. The primary mechanism of growth in the scale stage is mergers and acquisitions, and once a market moves past the scale stage, focus gradually shifts to using optimization strategies to drive continued growth.

Why Care About Market Concentration?

On some level, it may seem like nothing has changed. New research in the last 5 years on this topic has been slow to emerge, and new guidance does not necessarily change conditions on the ground in Georgia. But the new guidance does offer a chance to reframe thinking about dental market concentrations, as well as an opportunity to reflect on the benefits and drawbacks of varying levels of consolidation.

The fact of the matter is that a concentrated dental insurance market influences the business of dentistry. This is unsurprising considering the history of research into how market consolidation, in both insurance and provider markets, influences the practice of healthcare. Market consolidation may affect both the price and quality of care, though evidence for effects on quality remains mixed. For dentistry, peer reviewed papers suggest that increasing concentration in the dental insurance market puts pressure on dentists to consolidate, and degree of market consolidation influences pricing. According to 1 study, a 10 percent increase in dental insurance concentration (HHI) is associated with a 1.95 percent decrease in payments to dentists, and the association holds to a lesser degree in the other direction with higher dentist concentration modestly boosting gross payments. For consumers, lower prices can be helpful, especially for the 13% of the population reporting cost barriers to dental care. Still, lower prices mean less revenue for offices located in underserved areas with high Medicaid populations, potentially putting financial pressure on those offices to reduce and replace the publicly insured portion of their case load.

What Can I Do Right Now?

No single person can exercise total control over market conditions. However, groups have significant leverage to enact change. Conversations about new models of dental practice are ongoing, and it is clear that plenty of entrepreneurial creativity continues to drive the practice of dentists and their professional associations. One ongoing effort that helps to control practice expenditures is the Georgia Dental Association’s member owned GDA Plus+ Supplies Program. Purchasing through the association can lead to significant savings for practices unable to purchase supplies at the scale of larger corporate organizations, and it helps keep other suppliers’ prices in check. These kinds of partnerships, finding opportunities to achieve the benefits of scale while maintaining autonomy, are one mechanism by which solo and small group practices can continue to survive and thrive.

Advocacy for sensible policy which promotes both access to care and viable dental practice is always ongoing. Advocating for appropriate Medicaid reimbursement rates, regulating unfair insurance practices, and promoting patient safety is an ongoing process. To stay informed, continue to tune into our legislative updates. In these articles, we also like to offer a reminder the Georgia Dental Association offers many opportunities to get involved in policy advocacy through our contact dentist program, LAW day, and supporting GDAPAC. Your support makes all the difference.